October 2025

Investors, partners, and friends,

We are pleased to share our inaugural update letter from Nine Dean. We are a holding company that seeks to acquire stable operating companies and generate long-term value for all stakeholders. We review many potential acquisitions and transactions across industries and absorb knowledge that informs how we view the markets and where we look for opportunity. We want to share with you our observations and insights in hopes that they can be useful in your work and beyond. We plan to do this periodically, as trends that we find interesting arise.

Before we dive into our pipeline and market updates, we begin with the recent announcement of our Board of Managers. As we were structuring the holding company for Nine Dean, we sought to create a distinctive governance architecture that would result in transparency and significant shareholder controls. To that end, our investors ultimately vote on our Board and the Board, in turn, approves any transactions that we do. This is designed to align stakeholders for the long-term.

Here we share the names of our Board Managers, who serve alongside founding member Aren LeeKong:

Great organizations are defined by their people, and our Board is a big piece of what makes Nine Dean unique. We are honored to have this group of individuals join and serve as Managers.

As long-term investors, our mission is to build a sustainable, high-performing holding company that acquires and operates stable middle market businesses. We are looking for strong companies that have:

• Stable Financial Performance: Businesses with favorable and predictable financial results, including consistent cash flow generation, driven by quality products or services and minimal cyclicality. We pay close attention to trends like regulatory tailwinds that can further impact stability.

• Established Customer Relationships and Long-Term Contracts: We value companies with long-term contracts and deep customer relationships, as they reduce operational risk by providing predictability in revenue and cash flow.

• High Barriers to Entry and Competitive Advantage: Our focus is on businesses with defensible market positions, limited competition, and greater pricing power. These attributes help ensure resilience and long-term success.

• Minimal Commodity Risk: We look for companies with limited exposure to commodity-based factors, avoiding those where price fluctuations or related considerations could negatively impact the financial profile.

• Strong and Experienced Management Teams: Given our decentralized ownership model, a strong management team with a proven track record and deep industry knowledge is critical to our partnership and long-term value creation.

Our approach centers on sourcing opportunities primarily through direct relationships, with a conscious intention to sidestep competitive processes whenever possible. Given our aspiration to steward businesses for decades rather than years, the pace of many conventional processes usually does not align with our patient, long-term philosophy. Admittedly, we recognize that it will not always be possible to elude competition entirely. Yet, this year has brought more success on that front than we might have expected. As of September 2025, we have carefully reviewed 130 acquisition opportunities, and only three of these have involved competitive bidding.

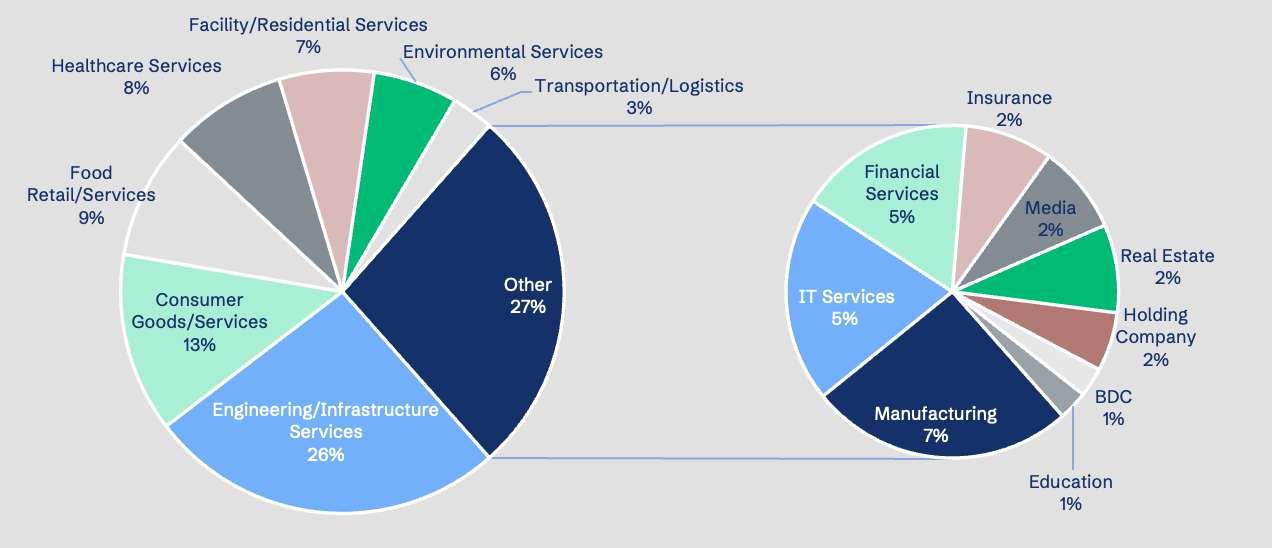

Here is a snapshot of the types of businesses we have reviewed so far:

Several intriguing patterns have emerged from our historical pipeline, and we wanted to share a handful of the more notable trends that have caught our attention:

• Roughly 80% of the opportunities we have reviewed center around service-based businesses, with especially strong representation in engineering and infrastructure services. The caliber of these firms continues to impress us, as many are remarkably resilient, having flourished for more than two decades.

• Approximately 16% of the transactions we’ve considered involve founders or owners seeking liquidity or prioritizing succession planning. This figure may even understate the broader opportunity, as we have encountered numerous situations involving established holding companies that have already acquired several founder-led enterprises. The so-called “greying of America” trend is unmistakably present, and we are witnessing its impact first-hand.

• Among smaller private equity firms capital raising remains heavily concentrated among the largest industry players, a dynamic we anticipate will persist. As a result, smaller general partners are creatively exploring alternative avenues to finance both new and ongoing investments. More than 33% of the opportunities under consideration involve direct sponsor capital support.

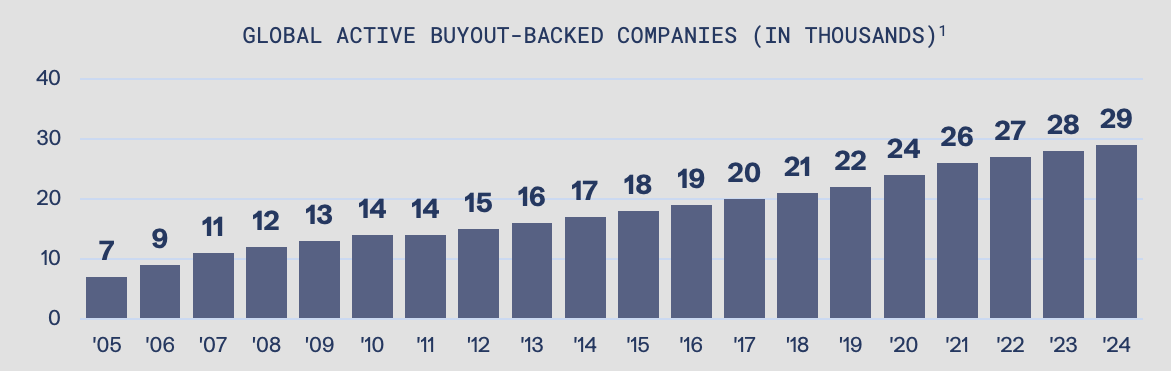

We have observed considerable activity surrounding portfolio companies acquired prior to 2020, the pre-COVID era. Many of these enterprises are fundamentally sound, performing steadily even if they haven’t quite reached their pre-pandemic projections. Some were perhaps financed with capital structures that depended on persistently low interest rates. In fact, 16% of transactions we’ve reviewed have involved efforts to de-lever and recapitalize these businesses. Nearly all of these opportunities arise from funds that are now approaching the ten-year milestone, prompting us to have frequent discussions with potential partners about our partnership model versus continuation vehicles or sales to secondary funds.

We believe that long-term capital partners are a breath of fresh air for these companies, and that long-term ownership is the right solution.

Finally, we have also started to see a few pre-Covid transactions in portfolios of direct lenders that are coming up on maturities that have upside down cap structures. Again, these situations typically involve good underlying assets that are constrained solely by their capital structure.

Overall, we’re really excited about the breadth of opportunities we are seeing. We look forward to sharing, in the future, a glimpse into Nine Dean’s process and progress as we evaluate opportunities and digest the private and public markets. We welcome the opportunity to hear your thoughts and further discuss any of this content - please drop us a line if you have questions or comments to share.

In partnership,

The Nine Dean team

P.S.

As we composed this letter, it occurred to us that it might be helpful to share several books currently taking up space in our collective imagination here in the office. When we contemplate transactions, we strive to look beyond the boundaries of Virtual Data Rooms and Excel models. Instead, we wholeheartedly believe in rolling up our sleeves and aiming to touch and feel the details. Our ability to interpret details is linked to our ability to broaden our perspectives. Therefore, a commitment to continual growth, both as professionals and as individuals, is required. To that end, we find ourselves engaged in many conversations (perhaps more often than strictly necessary) about books, podcasts, and television shows that have enriched our perspectives and, just maybe, made us wiser. Here are a few of our recent favorites:

1. Demon Copperhead by Barbara Kingsolver, a modern reimagining of Charles Dickens’s David Copperfield set in rural Appalachia.

2. Blood in the Machine by Brian Merchant, a historical and contemporary reflection on the relationship between labor and technology.

3. Behave by Robert Sapolsky, an exploration of human behavior through the lens of neuroscience, psychology, and sociology.

4. Nexus by Yuval Noah Harari, a brief history of information networks from the Stone Age to AI.

Footnote 1: "Global Private Equity Report 2025.” Bain & Company, 2025.

Forward Looking Statements and Other Important Disclosures

Nine Dean (“ND”) is distributing this inaugural periodic letter (the “Letter”) to current investors, prospective investors, potential acquisition targets, vendors, partners prospective purchasers of interests in ND (the “Securities”) and other members of the ND network (collectively the “Receiving Parties”).

This Letter is a confidential document. The Receiving Parties should read this Letter and complete their own due diligence before making a decision whether to purchase any Securities. By accepting this Letter, the recipient agrees that it will not, and will cause its directors, officers, employees and representatives to not:

• use this Letter or any other information furnished by ND for any other purpose;

• make copies of any part of this Letter or give a copy of this Letter or any other information furnished by ND to any other person; or

• disclose any information furnished by ND, including the information in this Letter to any other person without the prior written approval of ND.

If requested by ND, a Receiving Party must promptly return all copies of this Letter to ND if the offering is terminated or withdrawn or if a Receiving Party decides not to purchase the Securities. Any unauthorized distribution or reproduction of any part of this Letter may result in a violation of the Securities Act (as defined below) and the laws or regulations of other jurisdictions. If you are not the intended recipient of this Letter, you are hereby notified that any dissemination, distribution or copying of this Letter is strictly prohibited.

The Securities described in this Letter have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or the securities laws of any other jurisdiction. ND is offering the Securities in reliance on exemptions from the registration requirements of the Securities Act, including the exemption from registration provided by Section 4(a)(2) thereof and will not be registered or qualified under any state securities laws. These exemptions apply to offers and sales of securities that do not involve a public offering.

The Securities have not been approved or recommended by any federal, state, provincial or foreign securities authorities, nor has any of the Securities and Exchange Commission, any state securities regulatory authority or any other securities regulatory authority passed upon the merits of this offering or determined that this Letter is accurate or complete. Any representation to the contrary is a criminal offense.

The materials contained in this Letter are not, and under no circumstances are to be construed as, a prospectus, an advertisement or a public offering of securities and it is not subject to the form requirements for registration statements under U.S. securities laws. No prospectus has been filed with the Securities and Exchange Commission or any securities commission or similar regulatory authority in connection with the offer and sale of the Securities.

This Letter contains certain forward-looking statements within the meaning of applicable U.S. securities laws (collectively, “forward-looking statements” or “forward-looking information”) that involve various risks and uncertainties. Statements other than statements of historical fact contained in this Letter may be forward-looking statements, including, without limitation, management’s expectations, intentions and beliefs concerning anticipated future events, results, circumstances, economic performance or expectations with respect to ND, including ND’s business operations, business strategy and financial condition. When used herein, the words “anticipates”, “believes”, “budgets”, “could”, “estimates”, “expects”, “forecasts”, “goal”, “intends”, “may”, “might”, “outlook”, “plans”, “projects”, “schedule”, “should”, “strive”, “target”, “will”, “would” and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. These forward-looking statements may reflect the internal projections, expectations, future growth, results of operations, performance, business prospects and opportunities of ND and are based on information currently available to ND and/or assumptions that ND believes are reasonable. Many factors could cause actual results to differ materially from the results and developments discussed in the forward-looking information.

These statements are based on certain assumptions and analyses made by ND in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate. Whether actual results, performance or achievements will conform to ND’s expectations and predictions is subject to a number of known and unknown risks and uncertainties which could cause actual results and experience to differ materially from ND’s expectations. Although forward-looking statements contained in this Letter are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. Therefore, undue reliance should not be placed upon such estimates and statements.

All information in this Letter is as of date set forth on the front cover hereof unless otherwise noted. The Receiving Parties should not assume that the information contained in this Letter is accurate as of any date other than the date on the front cover hereof, unless otherwise noted, or that there has been no change in the affairs of ND since that date. ND has prepared this Letter and is solely responsible for its contents. Each prospective purchaser is responsible for making its own examination of ND and its own assessment of the merits and risks of investing in the Securities and ND does not expect to update or otherwise revise this Letter. This Letter do not purport to contain all of the information that a Receiving Party may require in making an investment decision.

This Letter may also contain summaries of certain documents. These summaries are not necessarily complete and the Receiving Parties should refer to the documents that have been summarized. Neither the delivery of this Letter nor any sale made hereunder shall, under any circumstances, create any implication or serve as a representation that there has been no change in the business or business plan of ND or its operating subsidiaries or its prospects or financial condition since the date hereof or that the information contained herein is correct as of any time subsequent to the date hereof.

Although additional information about ND or this private placement may, but is not required to, be provided to the Receiving Parties in one or more supplements to this Letter, ND undertakes to update or revise the information contained herein (or in any appendix, schedule or attachment hereto), whether as a result of new information, future events or otherwise and whether or not any such new information is material. Should any supplement to this Letter or any other additional information or documents be provided to the Receiving Parties, such information may be provided shortly before the Receiving Parties deliver their bids at pricing or need to reconfirm their bids upon allocation. Such supplement may be provided to the Receiving Parties verbally or in writing, and may be transmitted via telephone, voicemail, email, facsimile, mail or an alternative method, in each case in the sole discretion of ND. Prospective purchasers are on notice that these supplements may be delivered to them at any time. In addition, ND may, but is not required to, provide additional information to one or more Receiving Parties upon their request and this information will not necessarily be circulated to all the Receiving Parties. ND will offer the Receiving Parties the opportunity to ask questions of and receive answers from ND about ND, the terms and conditions of the Securities or any other relevant information. The Receiving Parties may contact ND at info@ninedean.com, if they need any additional information, including copies of any documents summarized in this Letter.

As a prospective purchaser of securities in a private placement not registered under the Securities Act, each Receiving Party will be deemed to acknowledge and represent that:

(i) it is aware of the need to conduct its own thorough investigation of ND and the Securities before making an investment in the Securities;

(ii) it is an institutional “accredited investor” as defined in Rule 501(a) under the Securities Act that is willing and able to conduct an independent investigation of the risks of ownership of the Securities;

(iii) if it is in Canada, it is an “accredited investor” within the meaning of National Instrument 45-106 or section 73.3(1) of the Securities Act (Ontario), as applicable, that is willing and able to conduct an independent investigation of the risks of ownership of the Securities;

(iv) if it is in the United Kingdom (the “U.K.”), it is a "qualified investor" as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”);

(v) if it is in any member state of the European Economic Area (the “EEA”), it is a "qualified investor" as defined in Regulation EU 2017/1129 (the “Prospectus Regulation”);

(vi) it has reviewed this Letter;

(vii) it has had an opportunity to request any additional information that it needs from ND;

(viii) ND is not responsible for, and is not making any representation concerning, ND’s future performance, the advisability of purchasing the Securities, the execution, validity or enforceability of the Securities or any documents delivered in connection with the Securities or the value or validity of any collateral or security interests pledged in connection with the Securities;

(ix) it will be acquiring the Securities for its own account and not with a view toward distribution or resale thereof in violation of the Securities Act or the securities laws of any other jurisdiction, and should proceed on the assumption that it must bear the economic risk of the investment in the Securities for an indefinite period of time; and

(x) it will execute, deliver and file such reports, undertaking and other documents relating to its purchase of the Securities as may be required by applicable securities laws, regulations and rules, or assist ND in obtaining and filing such reports, undertaking and other documents or provide ND with such information abouts it as may be required by such laws, regulations or rules upon request.

The Securities may only be resold or transferred if registered under the Securities Act or pursuant to an exemption from such registration under the Securities Act and in compliance with state securities laws and any other securities laws. ND has not taken any action that would permit a public offer or sale of the Securities. Accordingly, the Securities will be subject to restrictions on resale and transfer as provided in the note purchase agreement relating to the Securities and as provided by applicable U.S. securities legislation. The Securities will bear a legend referring to these restrictions.

By accepting this Letter, the Receiving Parties will be deemed to have acknowledged and agreed to all of the foregoing.

For further information, please contact one of the following:

info@ninedean.com